BRAVE Letter – Q1 2024

Dear Clients and Friends,

Happy 2024!

Last year was an excellent year for stocks as the major averages regained most of what they lost in 2022. We are not expecting 2024 to see similar returns as the economy slows and the U.S. market is once again pricey. However, a continued decline in inflation and interest rates will likely provide support to equity and bond prices with growth stocks and non-U.S. stocks poised to do best. In this letter we share an update on BRAVE, some recent changes that affect retirement savings and gifting, our current view on the markets, how we are implementing that view in managing our client portfolios, and a few administrative items.

BRAVE Family Advisors Update

BRAVE had a strong year of growth in 2023 with another year of record revenues.

Later this winter our team will be holding an offsite meeting. We’ll be reviewing the year that was, setting goals for the future, and hearing from at least one outside expert to help us continue to improve the company to serve our clients better.

A big “THANK YOU” to those of you who referred family members and friends to BRAVE last year. We continue to be excited to be able to work with additional individuals and families who can benefit from our services.

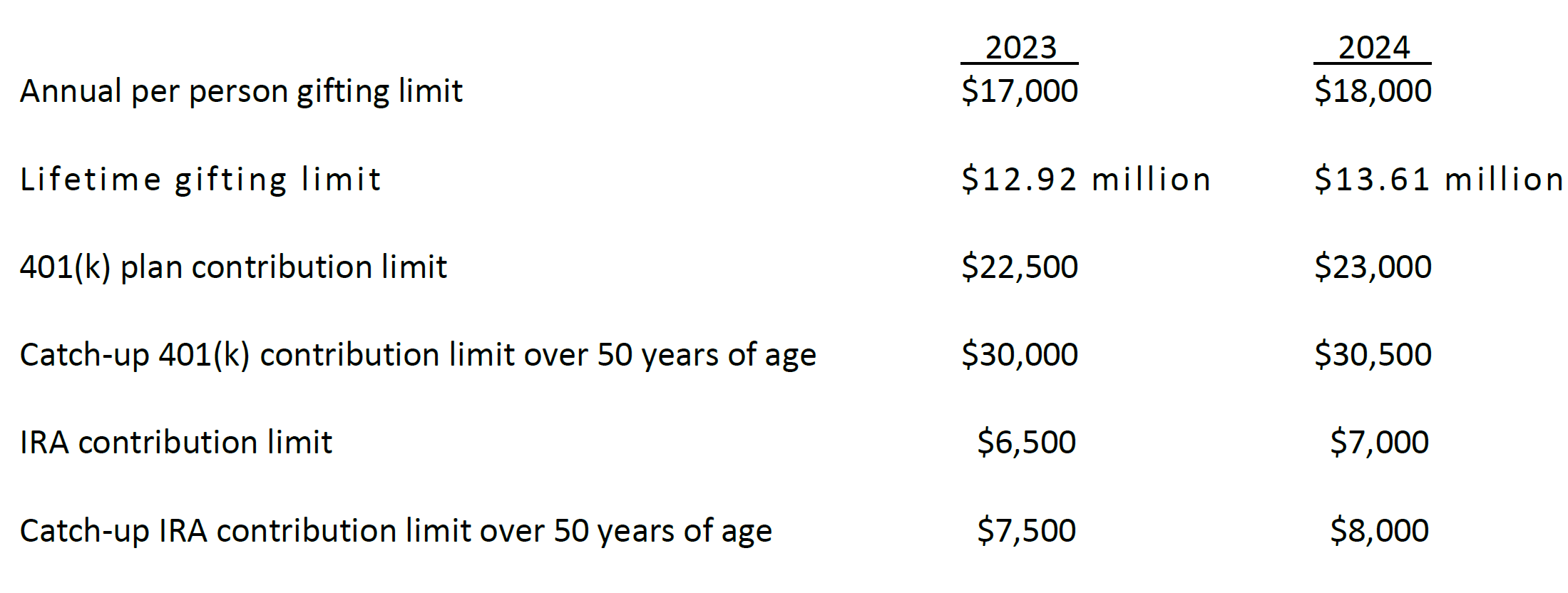

Increased IRS Limits

The Internal Revenue Service again increased the 2024 limits on gifting and the annual contribution limits on certain types of retirement savings plans as a result of the recent heightened inflation rate.

SECURE ACT 2.0 IMPACTS

A new law that contained a package of enhancements to retirement savings, titled SECURE Act 2.0, was signed into law in late 2022. We want to remind you of a few notable changes that may affect you and a modification of one important provision:

- Raised the age at which RMDs from retirement accounts begin to 73 in 2023 and 75 in 2033. If you turned 73 in 2023 then you need to take a RMD by 4/1/24 for last year.

- Catch-up contribution limits to 401k plans will be increased beginning in 2025 for workers aged 60-63 from the current $7,500 to $10,000.

- Up to $35,000 can be rolled over from a 529 plan that has been open for at least 15 years into a ROTH IRA account for the 529 plan beneficiary.

- The original legislation required that catch-up contributions for workers earning in excess of $145,000 would need to be ROTH contributions beginning in 2024. However, the Internal Revenue Service issued guidance last year that moves the enactment date to 1/1/26 due to difficulties in implementing the change.

Market Thoughts: Back to the Future

After an excellent year in the U.S. stock market in 2023, it is back to being expensive and some of the areas of recent relative overvaluation have reasserted themselves after correcting in 2022. This is occurring at a time that economic growth seems likely to continue decelerating and geopolitical risks around the world appear higher than typical. Long-term interest rates appear to have peaked as the market is increasingly confident that the Federal Reserve has succeeded in its battle against inflation and that a reversal in its monetary policy stance is inevitable.

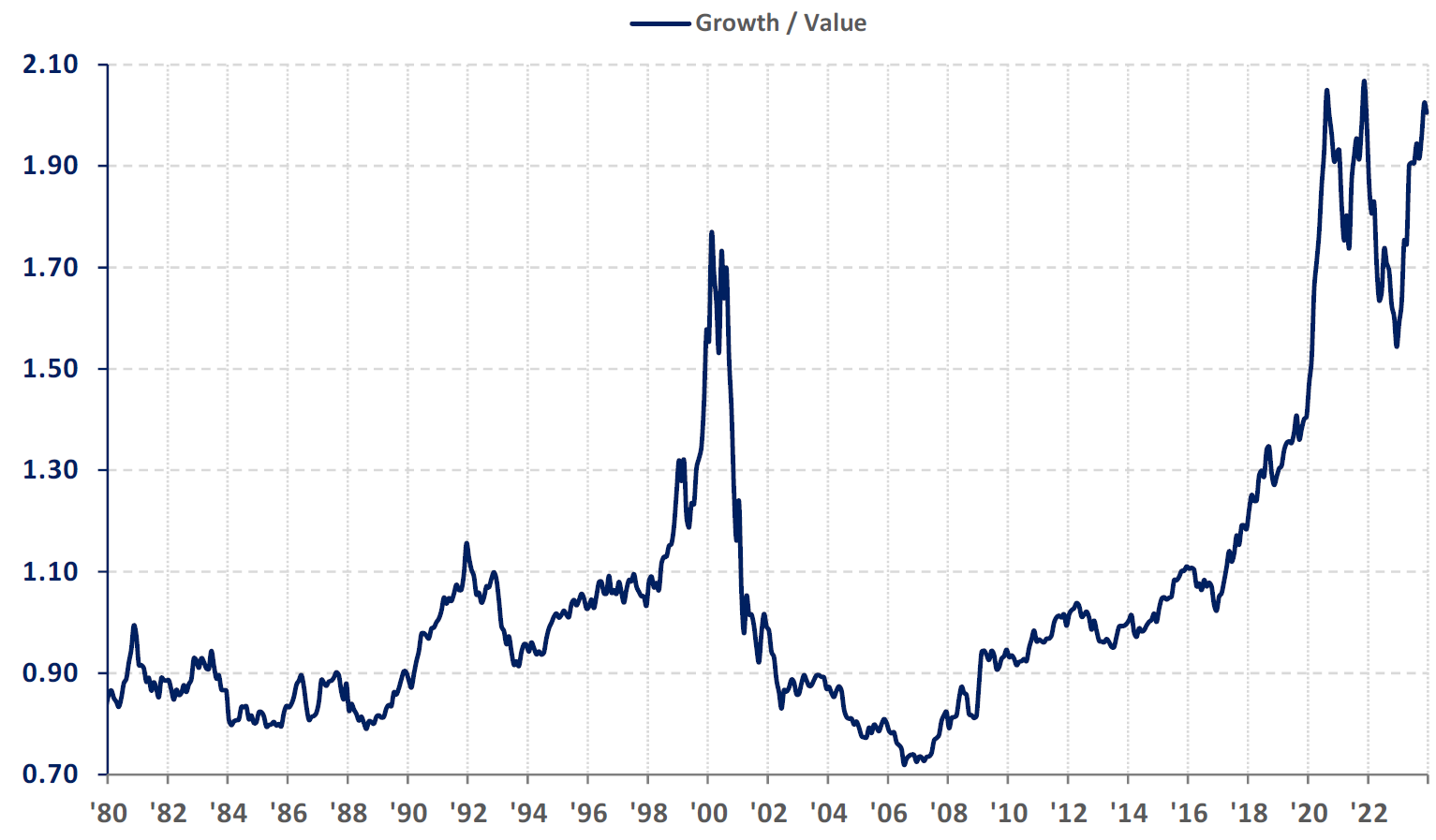

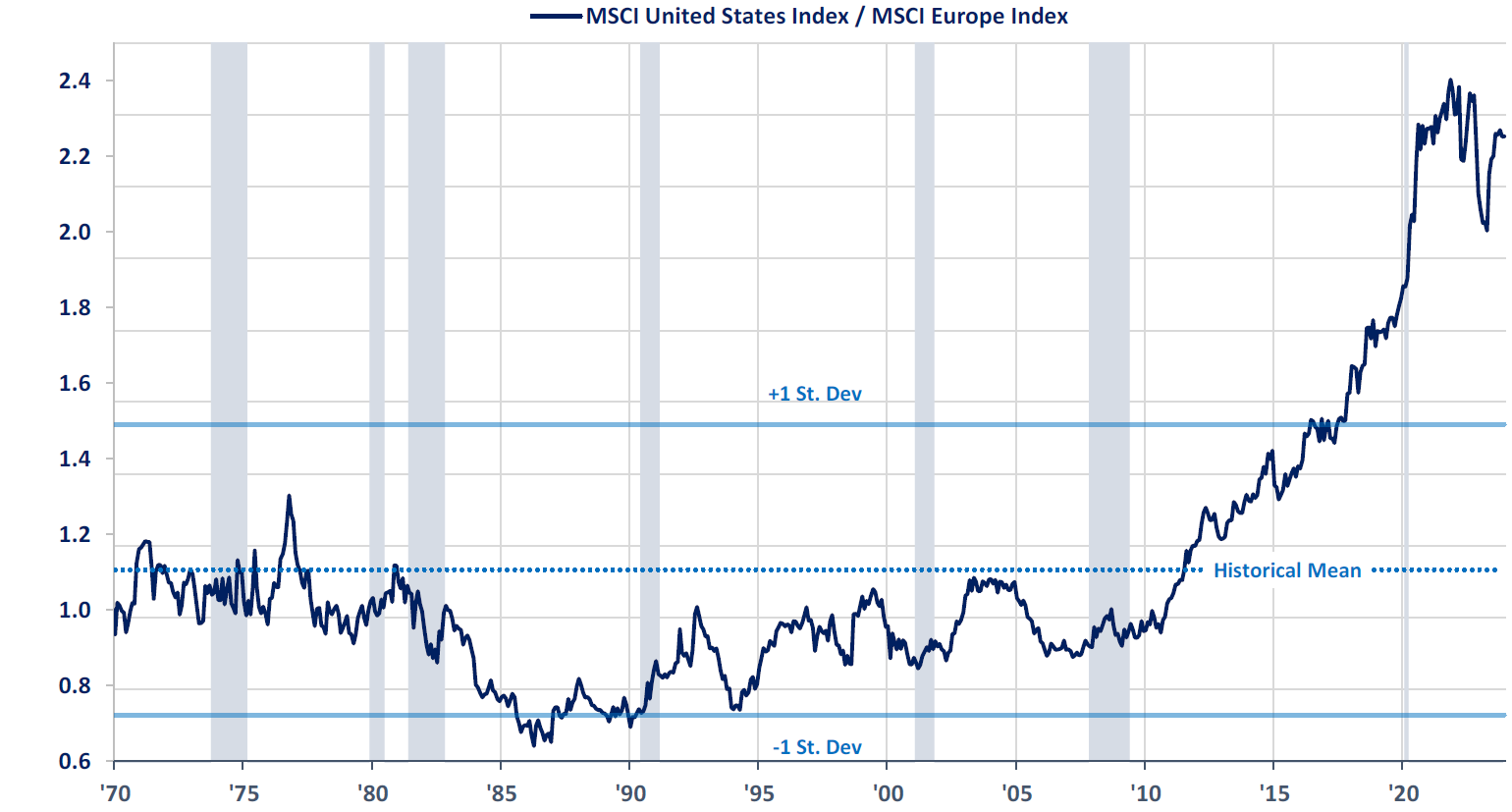

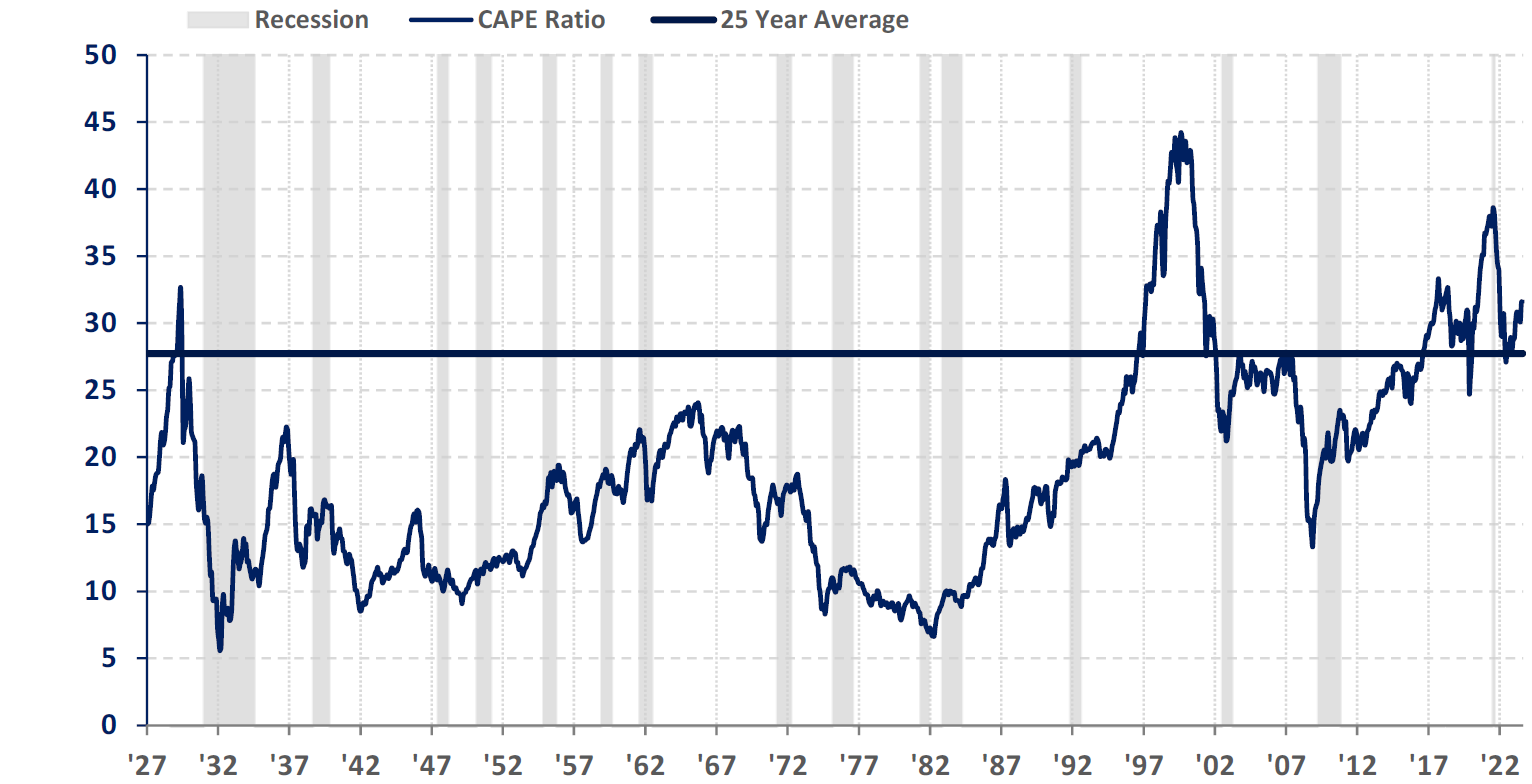

The S&P 500 Index was up 26.3% last year which brought it back to almost exactly the same level where it ended 2021. During the stock market correction in 2022, valuation in general and some of the areas of extreme overvaluation saw significant corrections. The ratio of growth to value (the way we measure it) experienced a 20% decline; the U.S. stock market relative to non-U.S. stock markets fell about 15%; the U.S. total market capitalization as a % of GDP declined by over 25%; and the CAPE (Cyclically Adjusted Price Earnings) ratio fell from 39 to 27 (Charts 1-4).

The recovery last year reversed those healthy corrections to varying degrees. U.S. growth stocks are nearly back to the extreme levels of valuation relative to value stocks seen in 2020 and early 2022. The U.S. market has retraced approximately 75% of its earlier correction relative to non-U.S. stocks. The ratio of U.S. market capitalization to GDP remains well below the peak of two years ago as the result of the high rate of nominal economic growth. However, the valuation level is well above all other times in the last 50+ years other than that seen in the last four years.

The current CAPE ratio suggests that U.S. stocks remain priced more richly than at any time in modern history other than the late 1920s, the dot-com bubble, and most of the last seven years. The fact that they are only a bit above the average of the last 25 years obviously raises the question of whether we have entered a new era of “permanently” higher valuations and that “this time is different” …the most dangerous four words in investing. The argument had been that high valuations were justified by low and declining interest rates. Now that those valuations have largely withstood an historic increase in interest rates calls that into question unless a significant further correction in valuation is to come.

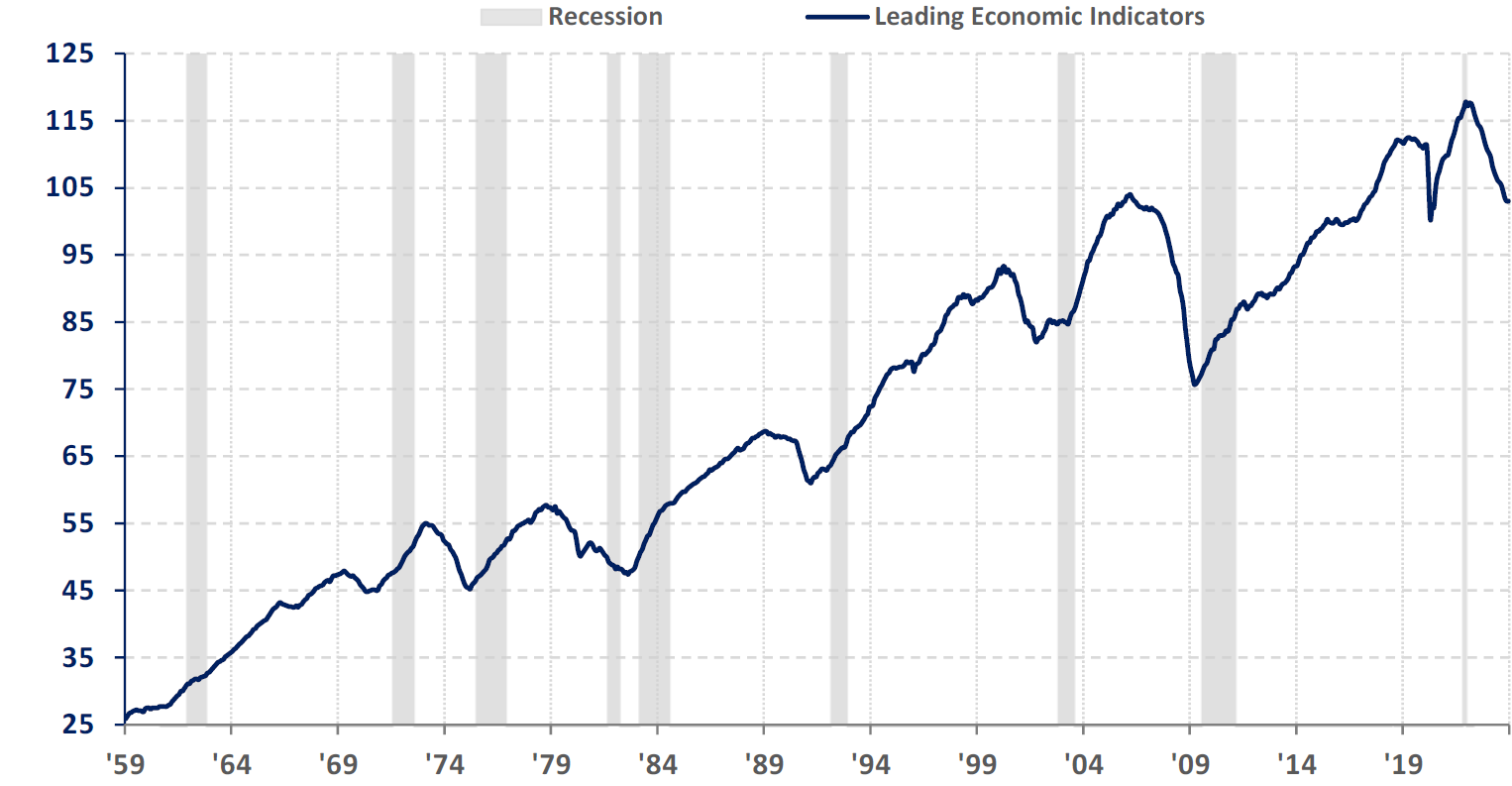

These relatively rich valuations are occurring at a time of heightened economic, political and geopolitical uncertainty. A significant decline in the index of Leading Economic Indicators has been a virtual fail-safe indicator of a looming recession over the last 65 years. We have experienced a 3+ year decline in that index which would suggest that the current economic slowdown will lead to a recession (Chart 5). This year seems likely to have its share of domestic political volatility with the Presidential election in November. Also, the risks of a broader conflict in the Middle East, uncertainty in Ukraine, and the China/Taiwan situation are all percolating in the background.

Chart 1: Russell 1000 Growth Index vs. Russell 1000 Value Index

Chart 2: U.S. Stocks versus European Stocks

Chart 3: Wilshire 5000 Total Market Capitalization to US Annual GDP

Chart 4: Long-term Historical Cyclically Adjusted PE Ratio with Recessions

Chart 5: Index of Leading Economic Indicators

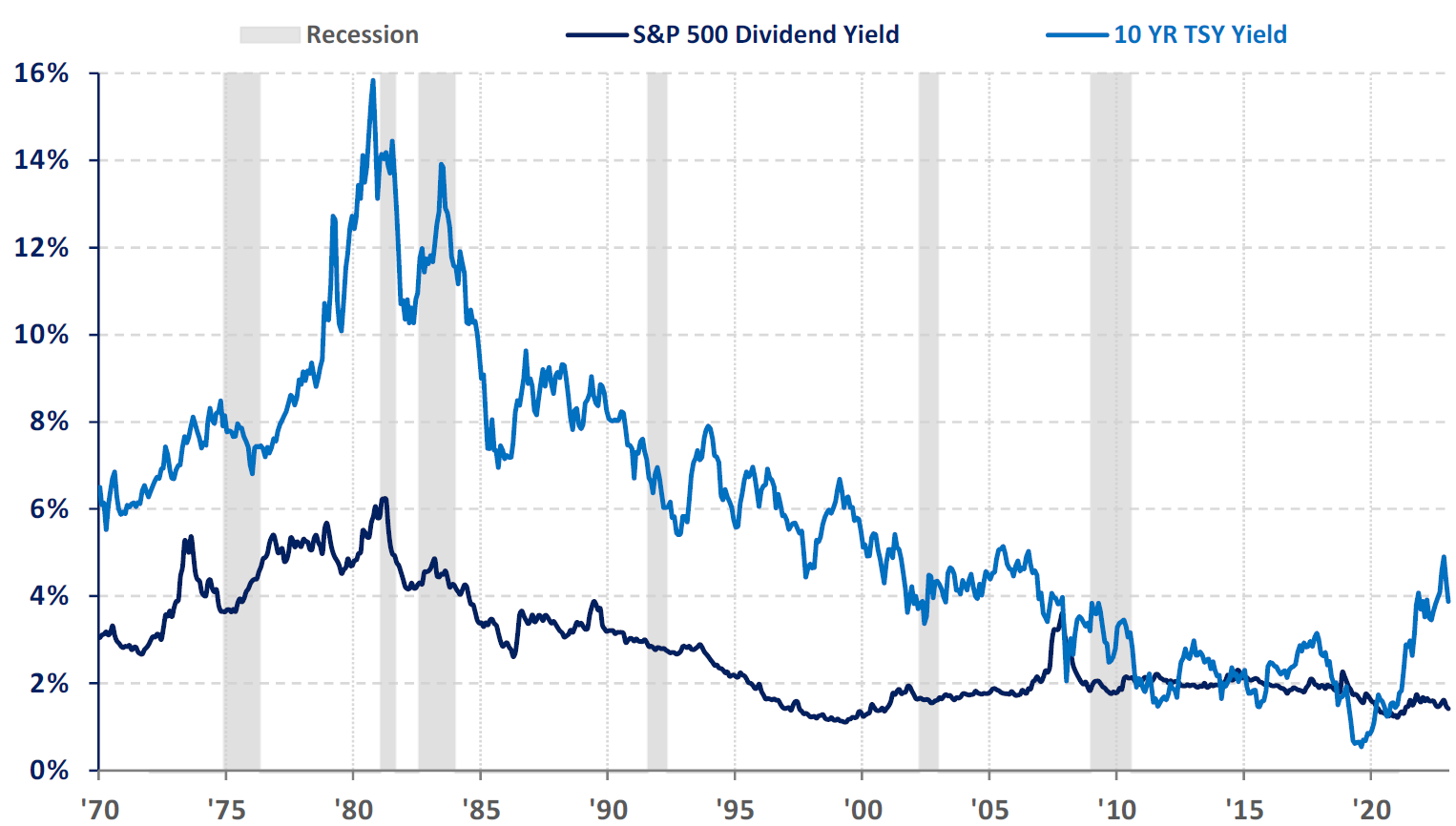

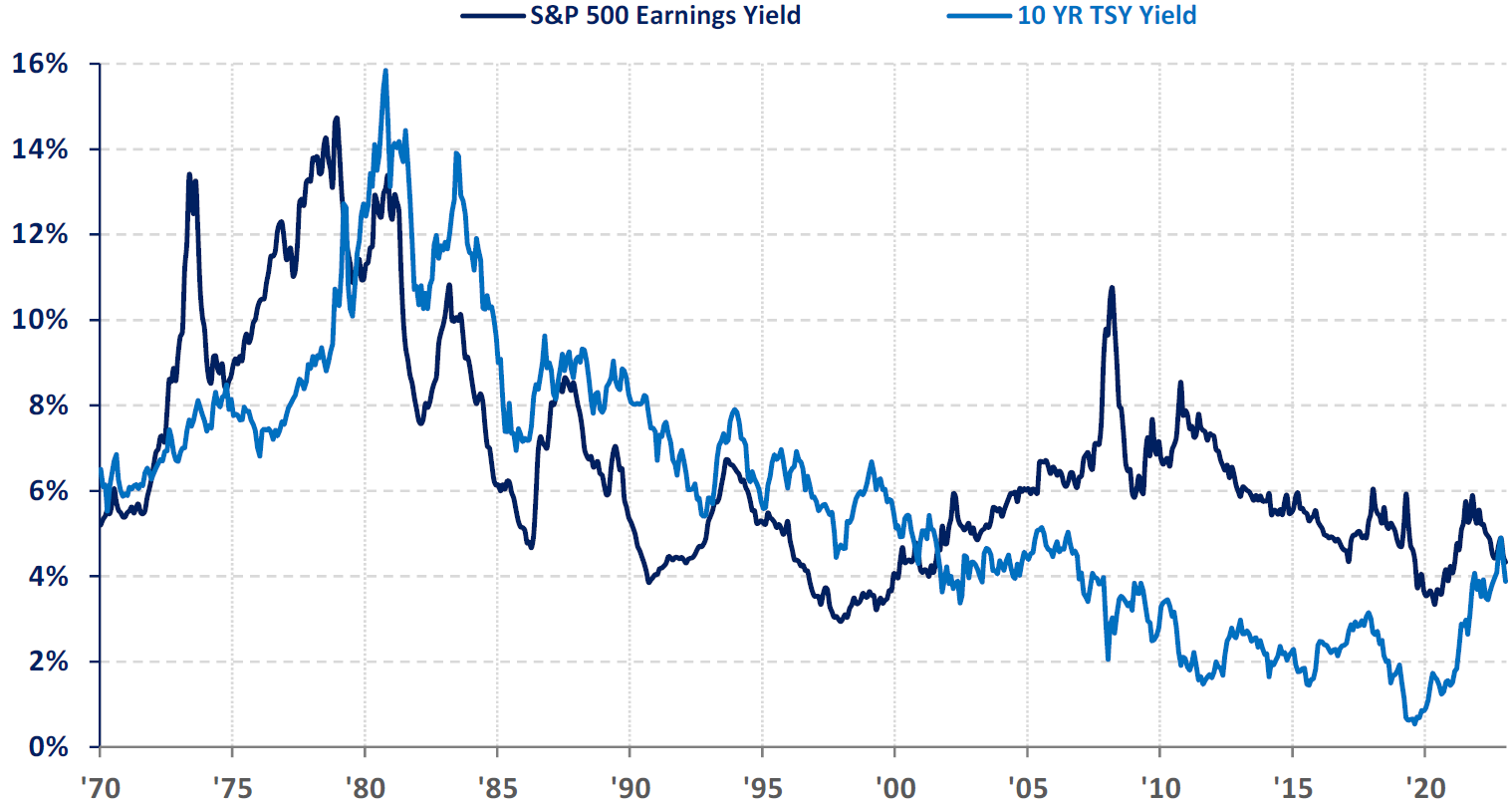

Bonds on the other hand appear to offer value relative to stocks after their significant declines last year. The yield on the 10-year Treasury note is at the widest premium to the dividend yield on the S&P 500 index in almost twenty years (Chart 6). The 10-year yield is also approximately in-line with the earnings yield (the inverse of the price earnings ratio) on the S&P 500 for the first time in almost twenty-five years (Chart 7). As mentioned above, this is happening at a time when the risk of a recession seems to be high based on some historically reliable indicators. An economic slowdown should be positive for bonds as inflation would likely continue slowing while being negative for stocks as corporate earnings would come under pressure.

Chart 6: S&P 500 Index Dividend Yield Versus 10-Year Treasury Note Yield

Chart 7: S&P 500 Earnings Yield Versus 10-Year Treasury Note Yield

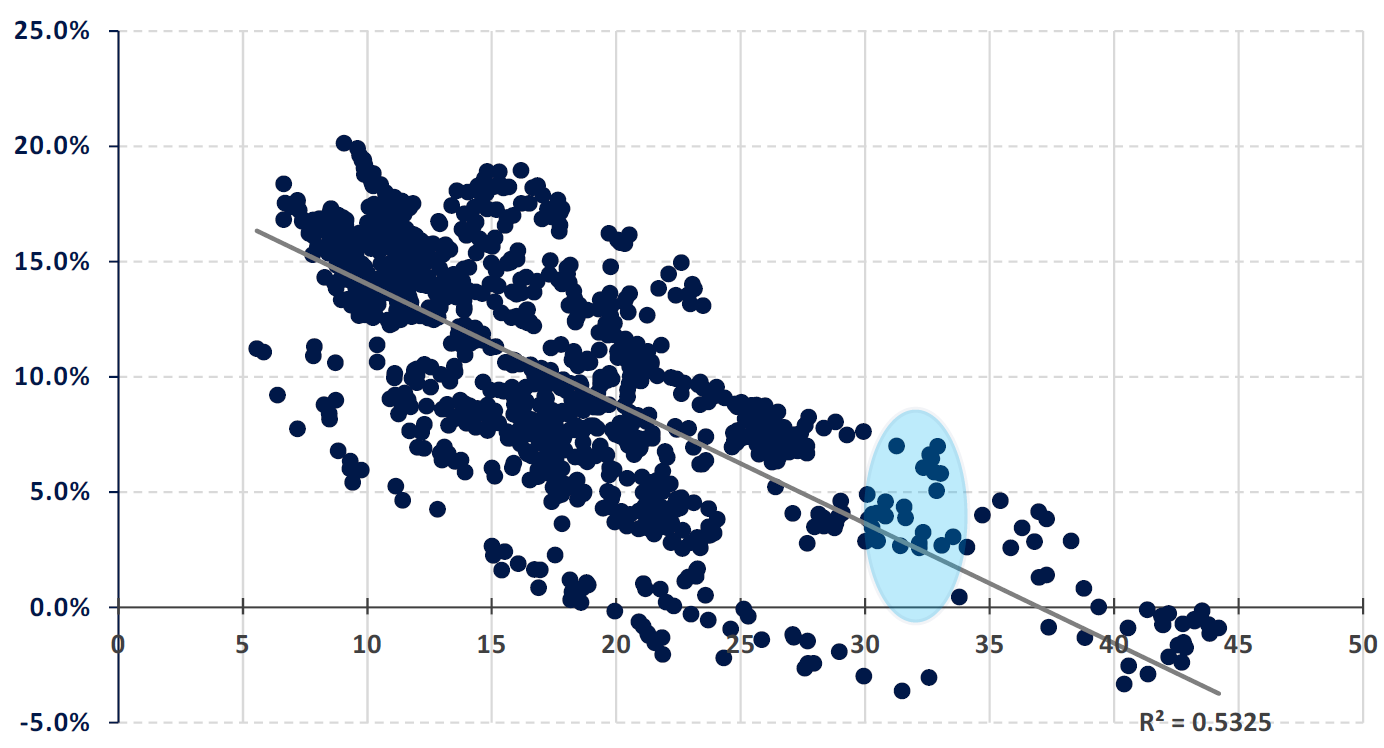

We remain of the belief that the continued high valuation of U.S. stocks doesn’t necessarily mean that disaster for stock returns lies ahead; however, it does suggest that future equity returns are likely to be below historical averages. There is a strong correlation between current valuation levels and future returns. Typically, the cheaper stocks are, the higher future returns will be and vice versa. This relationship can be seen in Chart 8 which illustrates the relationship between the beginning CAPE ratio and stock market returns over the next 10 years. A beginning CAPE ratio of around the current level of 31 has yielded 10-year future annual average returns in a range of -4% to +9% over the last 95 years with most being in the +3% to +5% range. This combined with the likelihood of positive returns from the bond market suggests that balanced portfolios have a good chance of seeing positive intermediate- to long-term returns.

Chart 8: Next 10 Year Annualized Returns of S&P 500 (Vertical Axis) vs. Beginning CAPE Ratio (Horizontal Axis)

Portfolio Management

We made some changes to most client equity portfolios in the fourth quarter of last year to reflect our thinking that economic growth will likely continue to slow and interest rates will generally decline with that trend. U.S. stock markets are definitely expensive, but they have been expensive for years and have continued to perform in-line with or better than their historical averages. There is an old investing saying, “Markets can stay irrational longer than you can stay solvent!”. Late last year we took losses on a high dividend exchange traded fund and a gold fund, neither of which performed as well as we had expected. We redeployed the proceeds of those sales into the Nasdaq 100 exchange traded fund (ticker QQQ). This security provides exposure to the 100 largest Nasdaq-listed stocks with a heavy weighting in large capitalization technology stocks. Although this segment of the market is not cheap, we feel that with slowing economic growth these companies have the best opportunity to continue growing revenues and earnings due to their dominant market positions in mega trends like cloud computing and artificial intelligence.

In our fixed income portfolios, we increased the duration of our holdings last year as we became increasingly convinced that the economy and inflation were beginning to slow. Portfolios are approximately in-line with benchmark duration and quality remains investment grade with the majority being U.S. Treasuries.

Administrative Items

The 1099s for regular investment accounts will be issued by Pershing LLC between February 1, 2024, and March 15, 2024, by Pershing. Please log into the NetXInvestor site to obtain your tax documents. You can find the tax documents under the Communications tab. We are happy to help your tax advisor as long as you provide us with authorization to speak to them. We can also set them up on our client portal so that they can directly access them. Please send an email to Suzie or Angie with their contact information.

We can provide you or your tax advisor with an estimate of your 2023 gains/losses and dividends/interest income for planning purposes.

Please be sure to enroll in on-line access with Pershing if you would like to avoid the new charges for paper copies.

You have until April 15 or when you file your tax return, whichever is earlier, to make a 2023 contribution to a ROTH or traditional IRA.

As always, we welcome your comments and questions. Please don’t hesitate to call, visit, or email at any time.

![]()