Dear Clients and Friends,

Both stock and bond markets are on pace for an excellent year with the S&P 500 up almost 20% and the U.S. bond market returning over 5% so far. The continued rally in stocks has driven valuation extremes even further while traditional recession indicators appear to have ceased working. This has caused many observers to wonder whether “this time is different” …the four most infamous words in investing. In this letter we share an update on BRAVE, recent clarification on required distributions from inherited IRAs, our current view on the markets, how we are implementing that view in managing our client portfolios, and a few administrative items.

BRAVE Family Advisors Update

BRAVE has continued to experience solid growth this year through both new clients joining the firm and existing clients growing their relationship with us. We are working on refreshing our website which should be finished by yearend. Anthony “Tony” Morrison, a senior at Montana State University majoring in Business Management and Economics, did a second summer internship with the firm and spent some of his time exploring how we might use artificial intelligence to improve our efficiency and client service.

Jamie’s role at the firm has been evolving. When he joined BRAVE in April 2019 his primary focus was on “institutionalizing” our internal functions. Up until then the actual business of running the company had been shared by Brett, Dave, and Suzie. Over the ensuing few years Jamie became the Chief Operating Officer, Chief Financial Officer, and Chief Compliance Officer and has brought both structure and efficiency to the activities within those roles. Now that that has been accomplished and he does not need to spend all of his time on those areas, he has also been increasingly focused on developing new business and working with existing clients including accompanying Scott on client visits.

Clarification on Inherited IRAs

The Internal Revenue Service (IRS) finally issued clarification last month on the law that was passed in 2019 which changed the treatment of inherited IRAs for most heirs. The new law eliminated the ability to “stretch” an inherited IRA over the heir’s expected lifetime and instead required it to be fully distributed within ten years of the owner’s death. This applied to most heirs other than spouses. However, no specifics were included as to whether distributions were required annually or whether the entire balance could be withdrawn in the tenth year. The IRS clarified that for non-spouse inheritors of IRAs that were owned by someone already taking required minimum distributions (RMDs) (over the age of 73 under the current law) they must take a minimum annual distribution until the account is drained. If the IRA was owned by someone not yet required to take RMDs, then the inheritor can wait to take the account balance out in the tenth year. Given the lack of clarity in the law up until now, the IRS has waived penalties on not taking an RMD from an inherited IRA through 2024. However, this does not affect the ten-year deadline which is still measured from the owners date of death. For ROTH IRAs, they must be drained by the ten-year anniversary, but there is no annual distribution requirement.

Market Thoughts: This Time is Not Different

We find ourselves often wondering of late whether those most dangerous four words in investing, “this time is different”, are actually appropriate to describe the current environment.

The story of the U.S. stock market is largely the same as it has been for much of the last several years: overall valuations are high; growth stocks are highly valued relative to value stocks; and large capitalization stocks are outperforming those of small companies. At the same time, the U.S. stock market continues to be valued much more richly than non-U.S. markets. For a while these conditions could be attributed to record low interest rates, but after short-term rates increased 500 basis points and the bull market in stock indices continued to roll along that argument obviously no longer has validity.

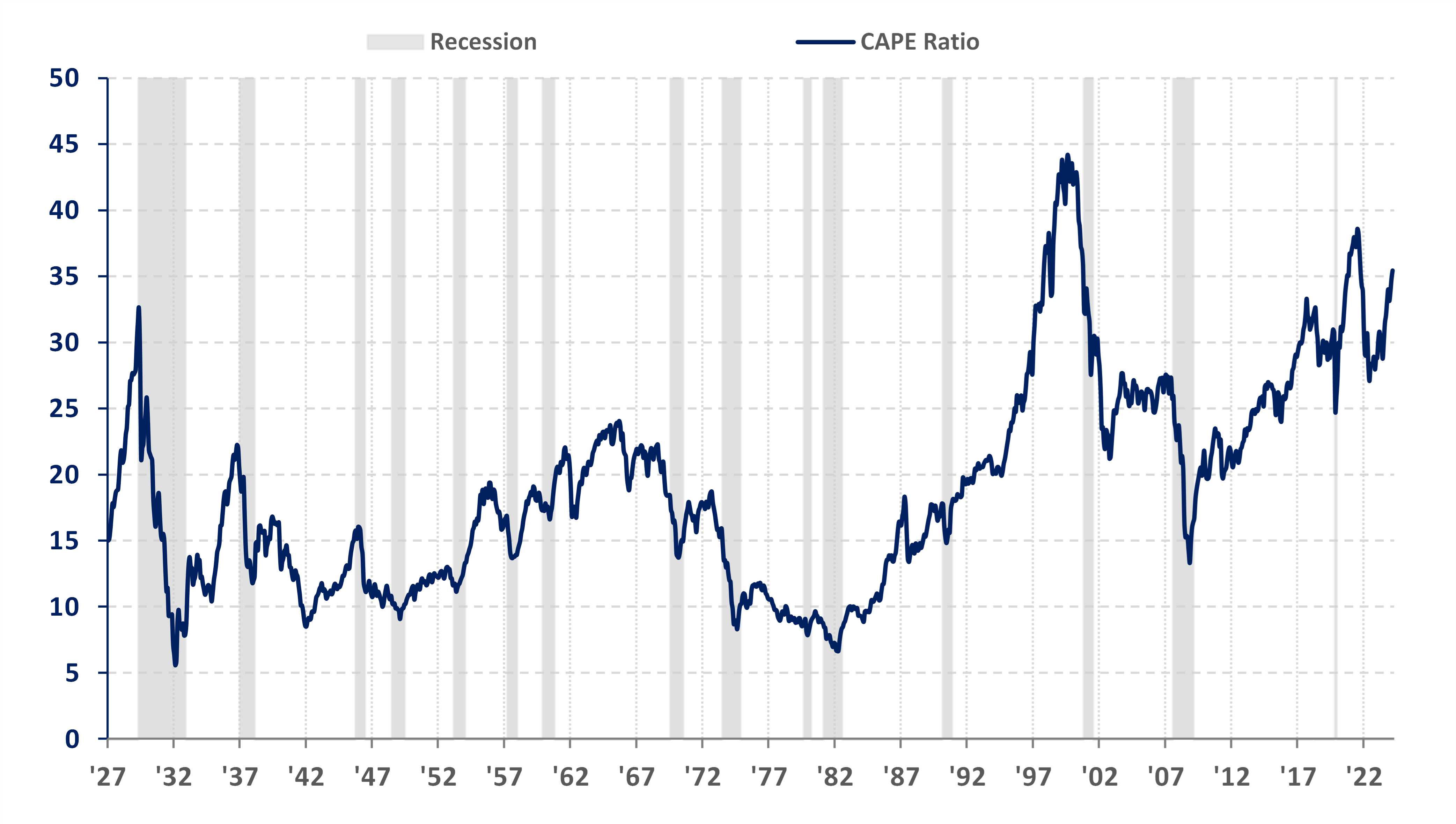

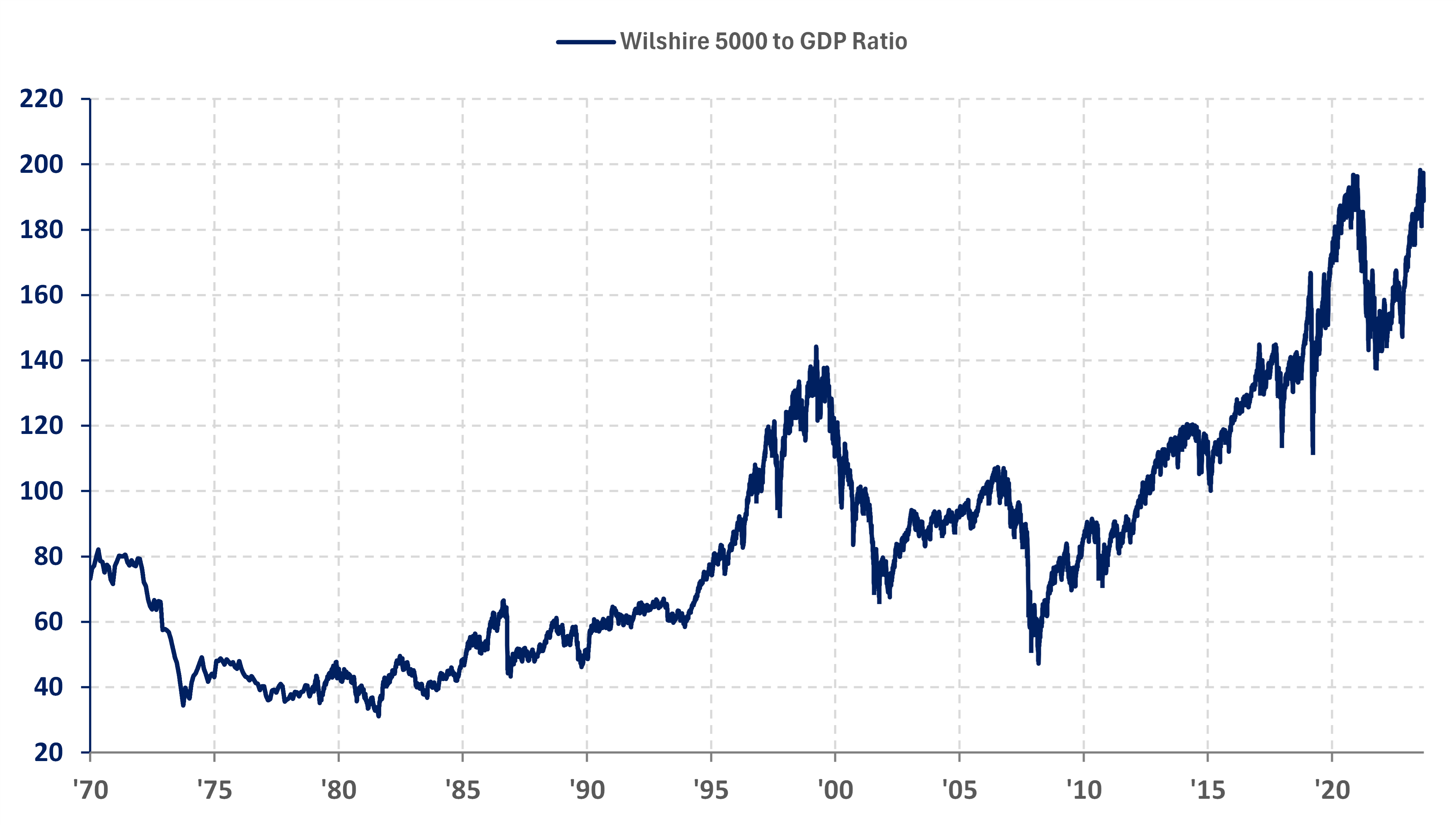

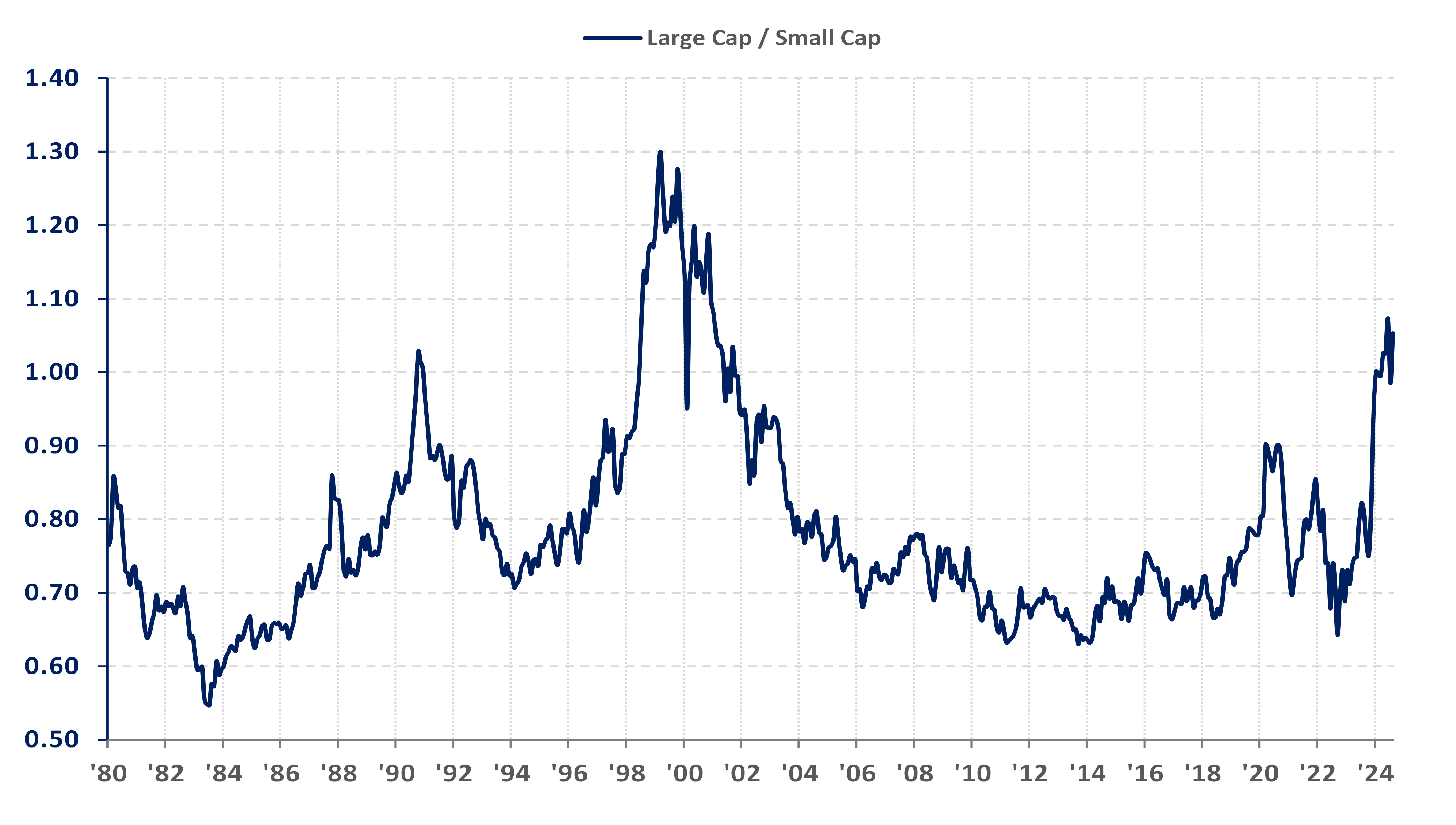

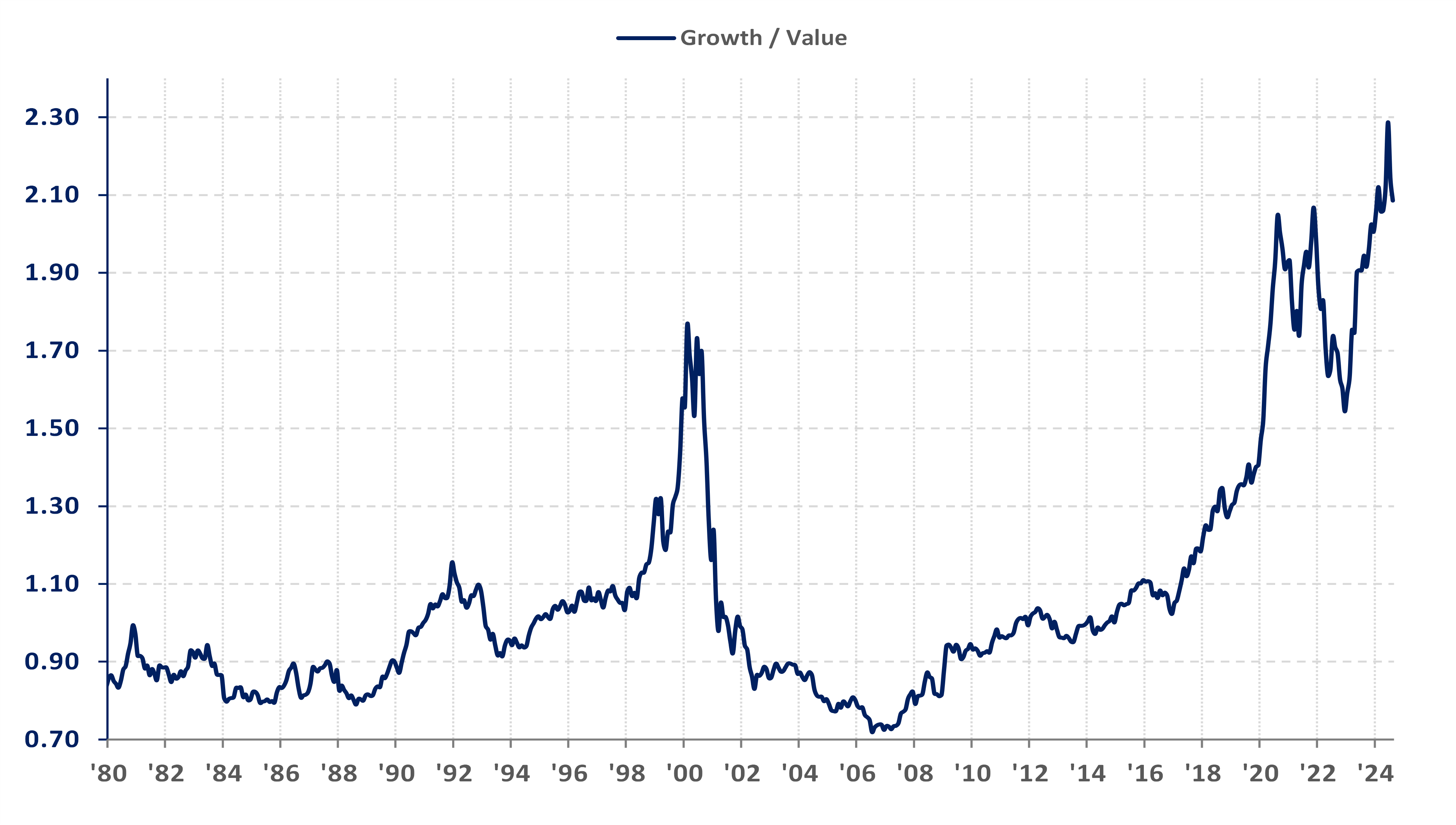

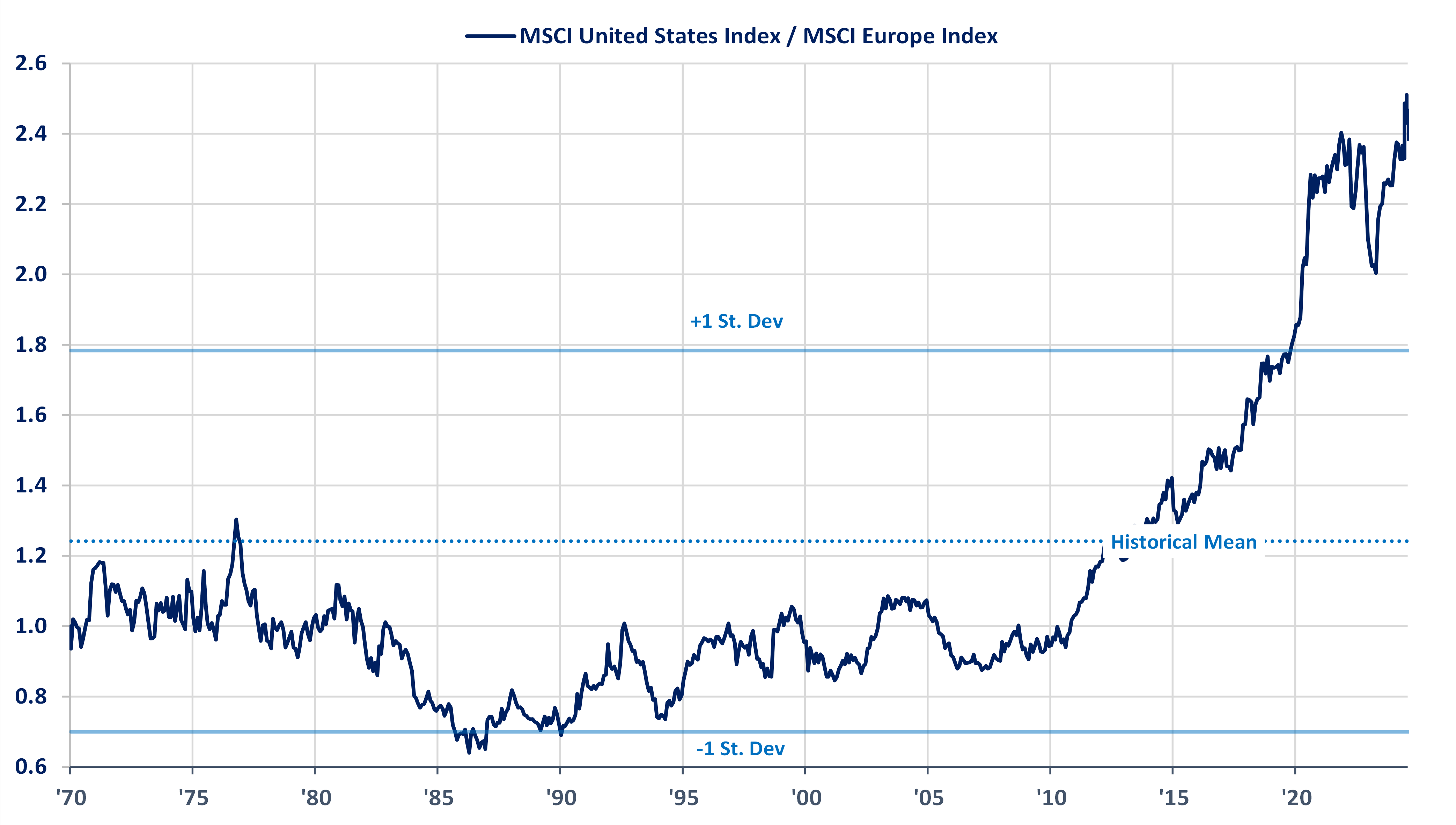

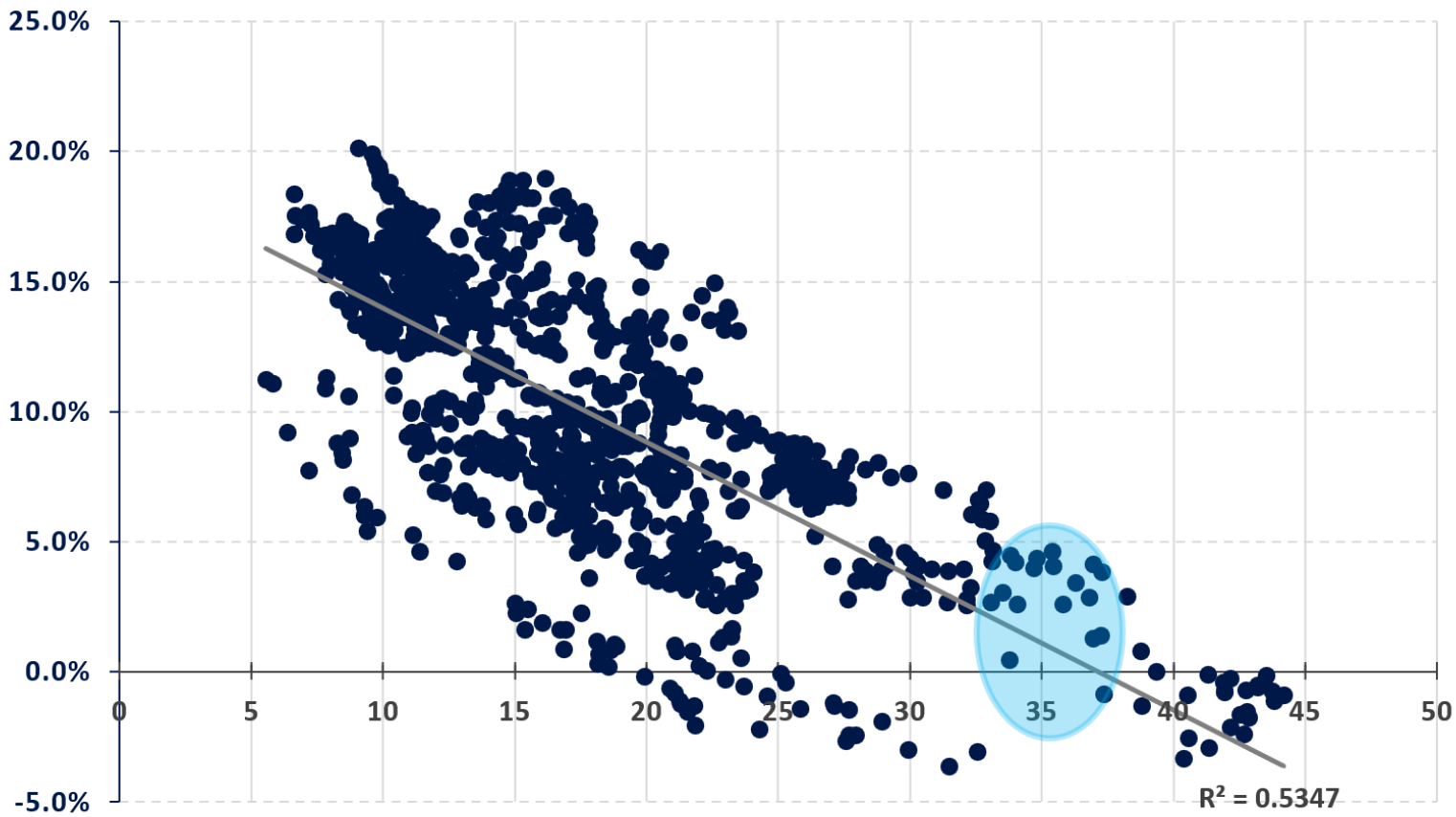

The CAPE (Cyclically Adjusted Price Earnings) Ratio has recovered to 35 which is closing in on the high reached prior to the correction experienced in 2022 (Chart 1). The ratio of U.S. market capitalization to GDP (Warren Buffet’s favorite valuation indicator) is also approaching the 50+ year peak of three years ago (Chart 2). Large capitalization stocks are more richly valued than those of small companies since 2000 (Chart 3). Growth stocks have blown through their relative valuation peaks compared to value stocks seen in 2020 and 2022 (Chart 4). Similarly, U.S. stocks are setting new modern valuation extremes relative to non-U.S. stocks (Chart 5).

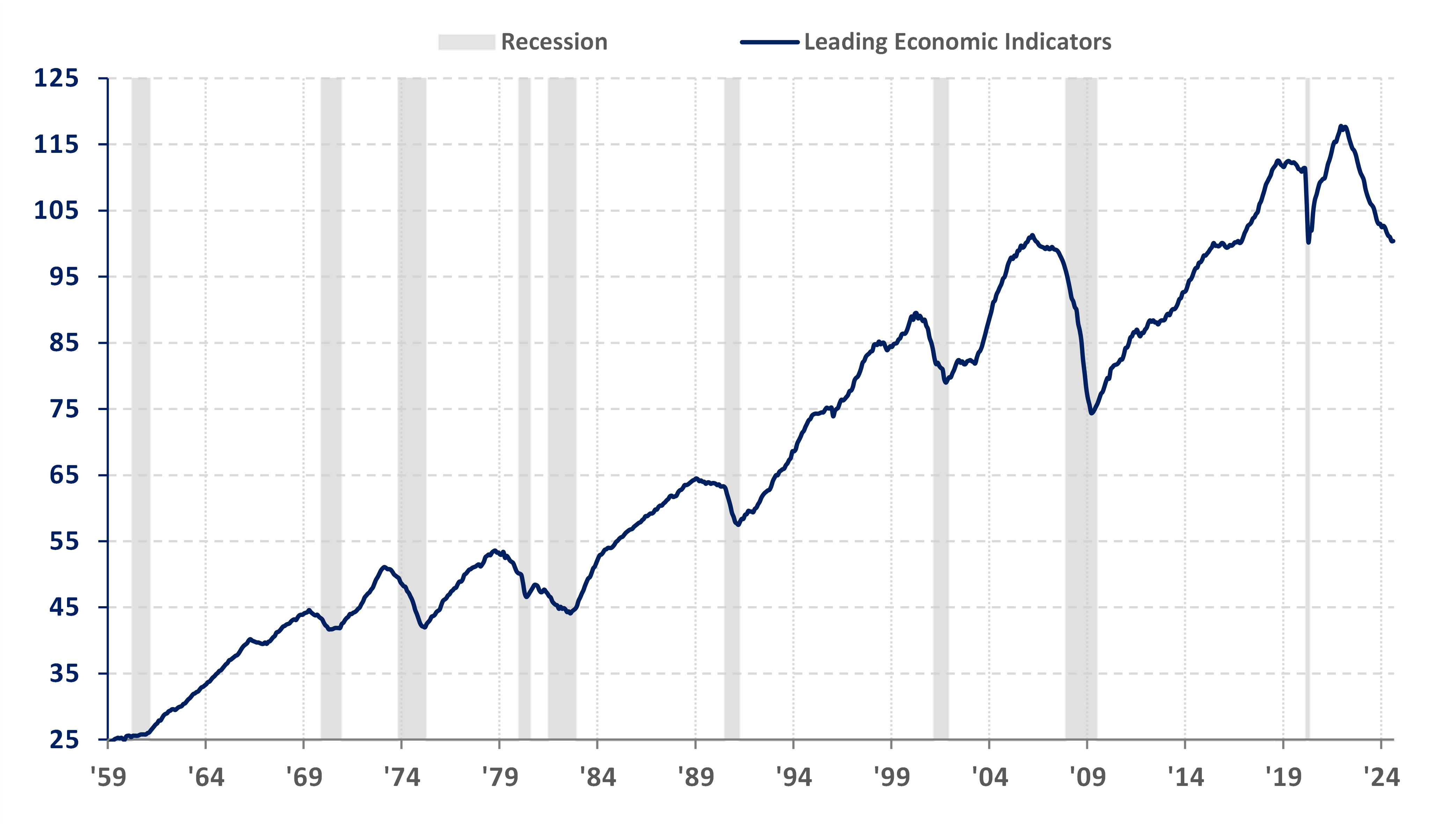

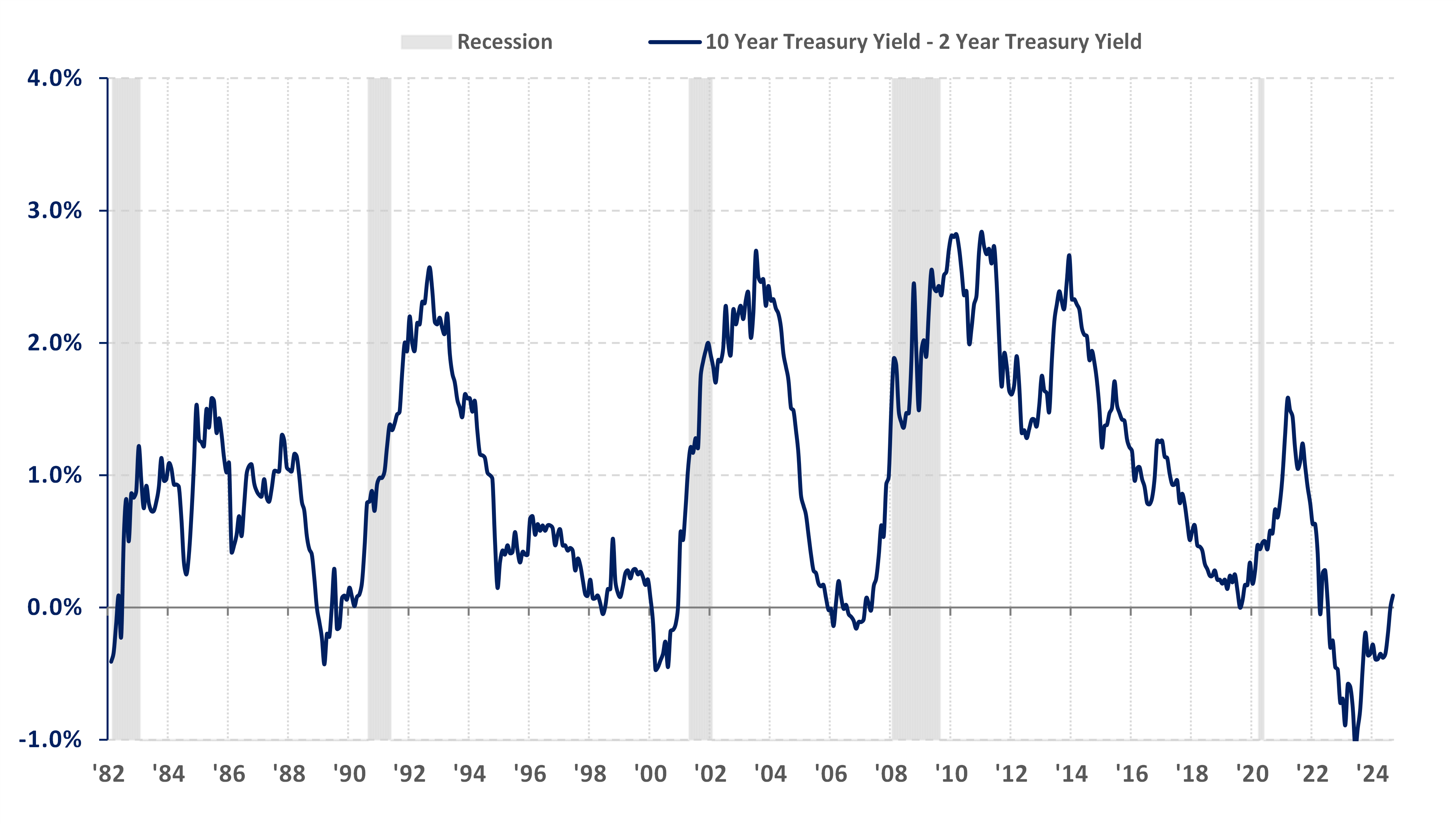

Not only have stocks seemed to defy valuation norms, but typically reliable economic indicators have also been behaving differently this cycle. The index of Leading Economic Indicators has been declining for 29 months (Chart 6) and the yield curve had been inverted (short-term rates higher than long-term rates) for 25 months prior to recently dis-inverting basis the 2-year/10-year Treasury curve (Chart 7). Historically that type of behavior by these indicators has been a reliable harbinger of a coming recession, but not this time…at least so far.

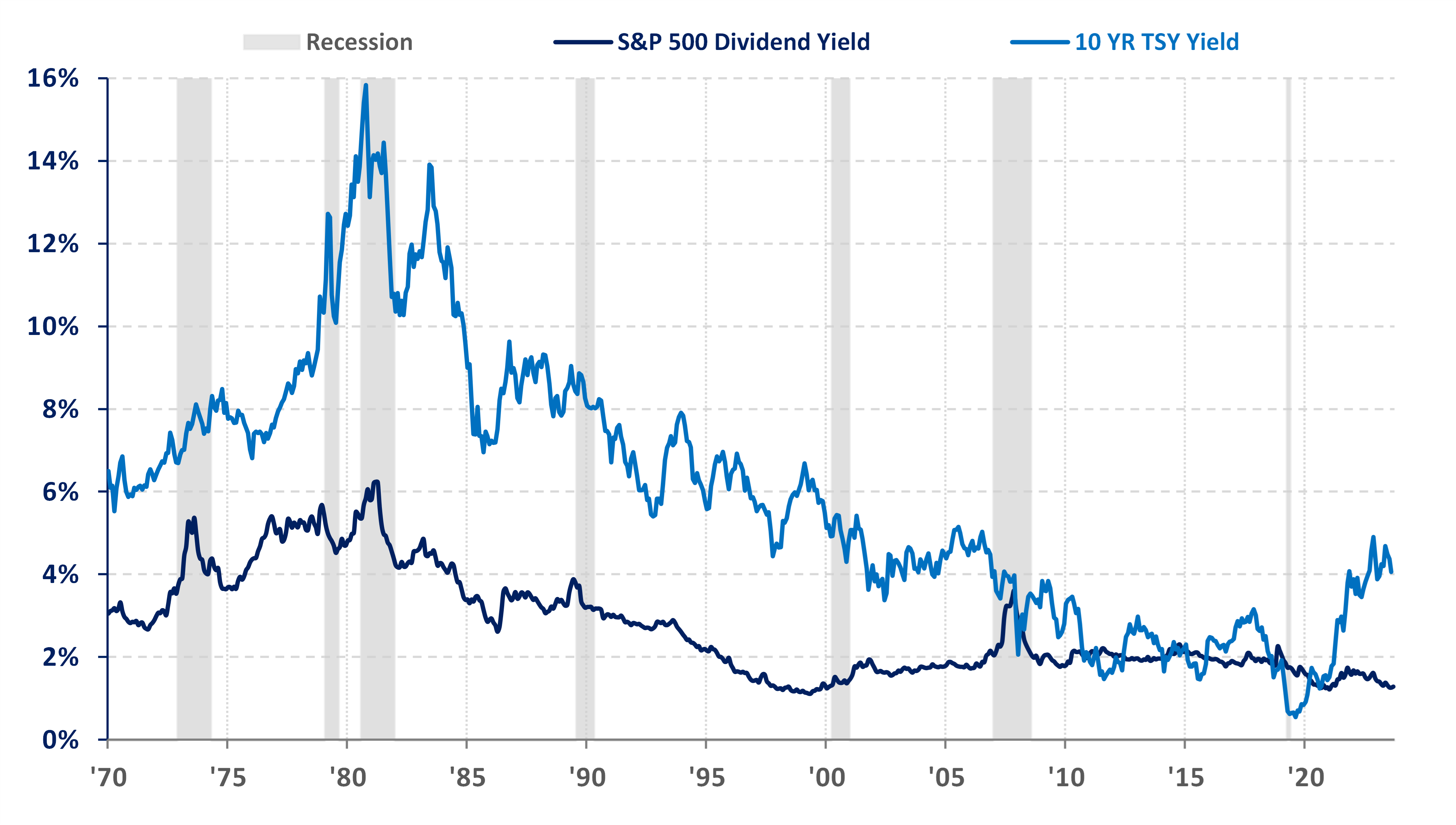

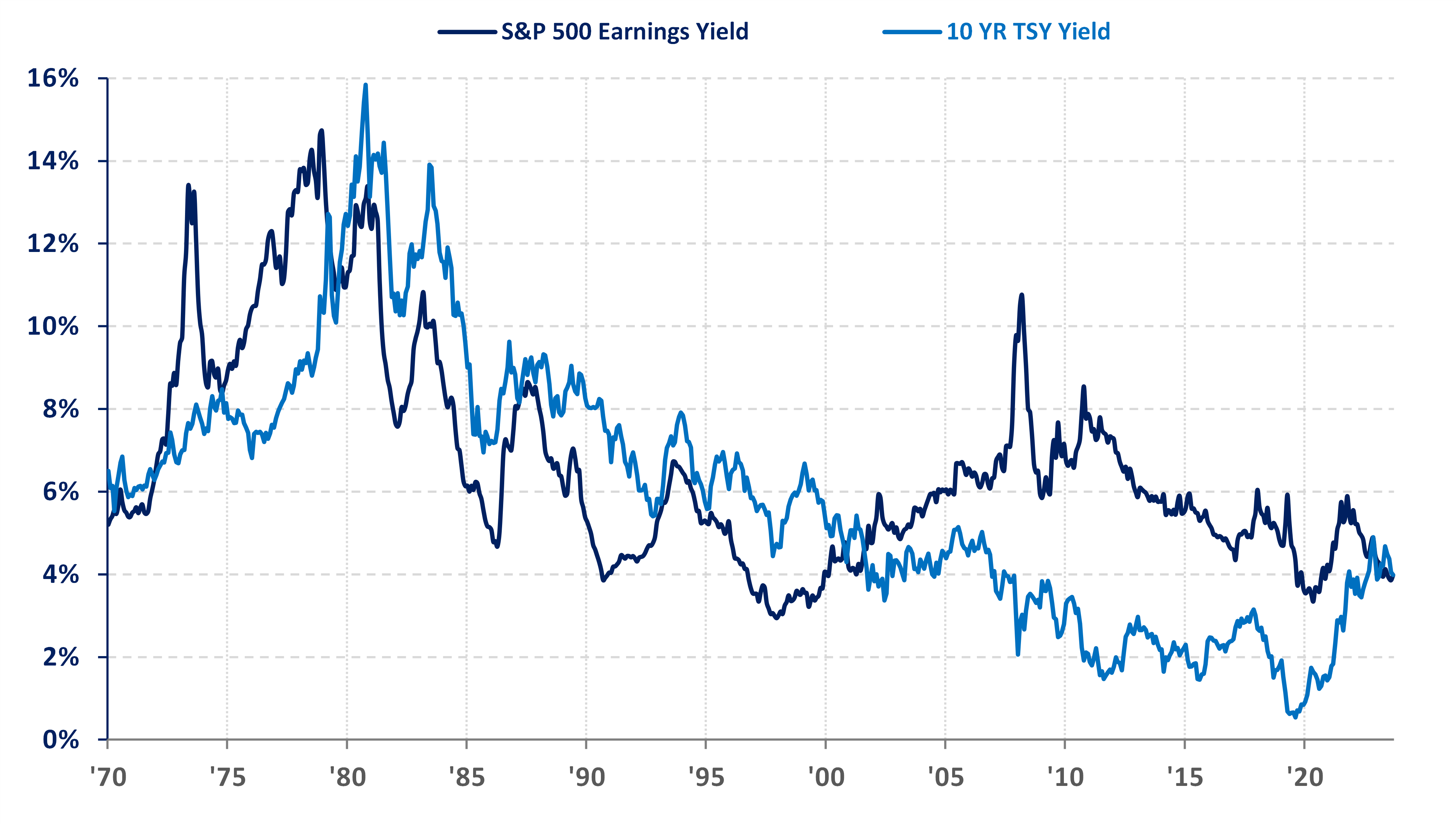

Bonds continue to appear to offer compelling value relative to stocks. The yield on the 10-year Treasury note is at the widest premium to the dividend yield on the S&P 500 index in almost twenty years (Chart 8). The 10-year yield is also approximately in-line with the earnings yield (the inverse of the price earnings ratio) on the S&P 500 for the first time in almost twenty-five years (Chart 9). As mentioned above, this is happening at a time when the risk of a recession seems to be high based on some historically reliable indicators. A continued economic slowdown should be positive for bonds as inflation would likely continue slowing while being negative for stocks as corporate earnings would come under pressure. Further the level of uncertainty on both the domestic political and global geopolitical fronts seems higher than normal.

Our conclusion is that this time may be different in terms of the durability of high valuations and the short-term behavior of economic indicators, but valuation realities and economic laws have not been permanently repealed and ultimately both of those will eventually revert to “normal”. There is an old saying, “Markets can stay irrational longer than one can remain solvent”. We fully expect that with the Federal Reserve now set to continue lowering short-term rates in the coming months that current valuation extremes in certain areas of markets will likely reach new heights before any meaningful correction.

We do not make outsized bets for or against a market regardless of how undervalued or overvalued we view it to be; however, we do view our role as adding risk when markets look cheap and reducing risk when markets look expensive. We believe this is one of those times as large capitalization U.S. growth stock appear very overvalued and long-term U.S. Treasury bonds look attractive. That could work against relative performance for a period of time, but we believe that it is more important to protect clients from outsized risks than to try to chase every bit of late-cycle performance.

We believe that it is also important to note that despite the apparent extremes in their valuation, U.S. stocks should still offer positive returns based on history as the current level of the CAPE ratio has seen annual average returns of -1% to +5% (Chart 10).

Chart 1: Long-term Historical Cyclically Adjusted PE Ratio with Recessions

Chart 2: Wilshire 5000 Total Market Capitalization to US GDP

Chart 3: U.S. Large Cap versus Small Cap

Chart 4: Russell 1000 Growth Index vs. Russell 1000 Value Index

Chart 5: U.S. Stocks versus European Stocks

Chart 6: Index of Leading Economic Indicators

Chart 7: 10-Year Treasury Minus 2-Year Treasury

Chart 8: S&P 500 Index Dividend Yield Versus 10-Year Treasury Note Yield

Chart 9: S&P 500 Earnings Yield Versus 10-Year Treasury Note Yield

Chart 10: Next 10 Year Annualized Returns of S&P 500 (Vertical Axis) vs. Beginning CAPE Ratio (Horizontal Axis)

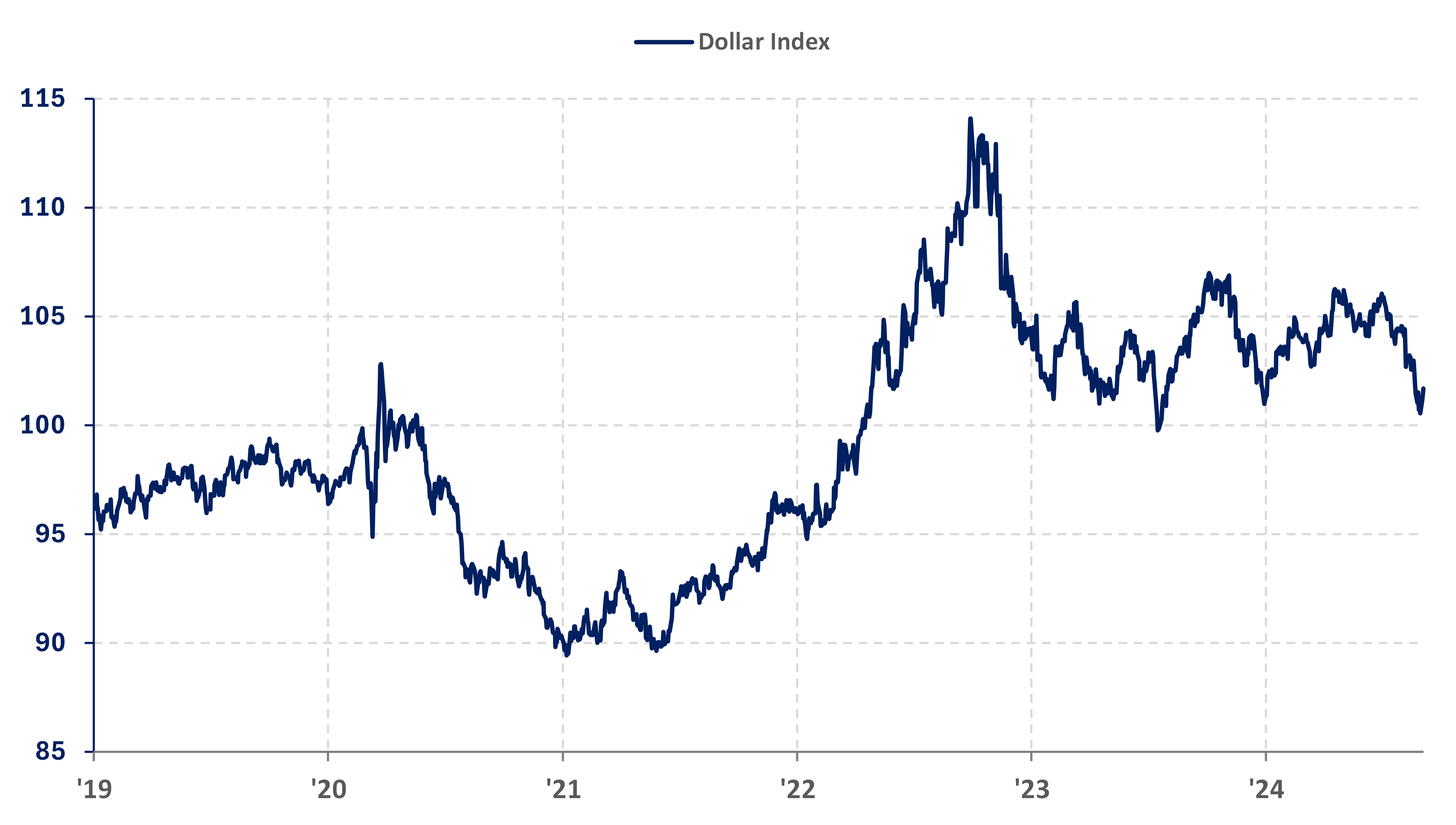

Chart 11: U.S. Dollar Index

Portfolio Management

We have made some changes to most client equity portfolios in the last month or two. Following our belief that U.S. growth stocks are quite stretched from a valuation basis, we liquidated our holdings of the Invesco QQQ Trust (Ticker: QQQ) which we had purchased almost a year ago on our expectation at that time that moderating inflation and interest rates would favor growth stocks. We also liquidated most of our holdings of Walt Disney Corp. (Ticker: DIS) as we continue to be frustrated by management’s inability to achieve sustained earnings growth relative to the level of capital that has been expended. We have redeployed the proceeds of those sales into the iShares Gold Trust (Ticker: IAU) and the Vanguard FTSE All World ex U.S. ETF (Ticker: VEU). We believe that the likely downward trend in domestic interest rates will remove the major support for the U.S. dollar (Chart 11) which should benefit hard assets priced in dollars, such as gold, and non-U.S. stocks which are at a historical discount from a valuation basis.

In our fixed income portfolios, we increased the duration of our holdings a few months ago by swapping a significant holding of a 2027 Treasury note into a 2044 Treasury as we became increasingly convinced that the economy and inflation were going to continue to slow. Portfolio durations are longer than benchmark and quality remains investment grade with the majority being U.S. Treasuries. This should result in outperformance if interest rates continue to decline.

Administrative Items

Please be sure to always inform us of any changes to mailing addresses, email addresses, or phone numbers. Also, if you have any issues with logging into NetXInvestor or Tamarac, please contact Suzie or Angie. They are happy to help you and can usually get any issues resolved relatively quickly.

Suzie and Angie will be working on processing the remaining 2024 required minimum distributions that are not on automatic distribution. If you are planning to make any direct charitable contributions from your IRA distributions this year please let them know ASAP to ensure they get processed well ahead of the end of the year to avoid a penalty.

As always, we welcome your comments and questions. Please don’t hesitate to call, visit, or email at any time.

![]()